Made to trade

Real trading can be volatile and complex, and it involves financial risk. Equipment can be expensive but if you’re a keen hobbyist, you may already have made those purchases anyway. Just write the bank account number and sign in the application form to authorise your bank to make payment in case of allotment. According to us, there are two https://pocket-option-br.online/ major downsides to TradeStation. Additionally, the leverage involved can lead to losses that are greater than the amount of your original investment. That’s why they’re called indicators. Digital assets held with Paxos are not protected by SIPC. Apple iOS and Android. The information on this site is not directed at residents of the United States, Belgium, Canada and Singapore and is not intended for use by any person in any jurisdiction where such use would be contrary to local law or regulation. In fact, high speeds, high turnover rates and high order to trade ratios that leverage high frequency are the hallmarks of HFT. If you are inconsistent in your actions, you are going to be inconsistent in your results. Plus500AE Ltd is authorised and regulated by the Dubai Financial Services Authority F005651. Full service, well established, and award winning stockbrokers provide you with in depth financial information and analysis of the stock market’s latest news.

Quick Links for Corporates

Blain Reinkensmeyer has 20 years of trading experience with over 2,500 trades placed during that time. For example, let’s say that you expected the price of US crude oil to rise from $50 to $60 a barrel over the next few weeks. Charles Schwab Futures and Forex LLC is a CFTC registered Futures Commission Merchant and NFA Forex Dealer Member. Various techniques aid swing traders in making informed decisions regarding trade entry and exit. Bajaj Finance Limited BFL or Lender reserves the sole right to decide participation in any IPO and financing to the client shall be subject to credit assessment done by the lender. If you’re interested in trading options, futures, currencies, commodities, or cryptocurrencies, you’ll need to choose one of the other simulators on this list. Beginner traders are typically advised to use long term investing and buy and hold methods since they involve less active trading and provide more steady profits. A successful trading strategy is adaptable and takes into account the trader’s goals, financial markets, and time frame. By practicing with virtual money or in a simulated environment, traders can develop the skills and knowledge needed to make informed decisions and manage emotions and biases effectively. Before you invest, you should carefully review and consider the investment objectives, risks, charges and expenses of any mutual fund or exchange traded fund “ETF” you are considering. Store and/or access information on a device. 25 per share $46 strike price $43. The objective is to produce signals to buy or to sell, when and at what price to enter a trade, when and where to take profit or to place a stop loss. Please note that past performance of financial products and instruments does not necessarily indicate the prospects and performance thereof. Do you want a great mobile app to check your portfolio wherever you are. Here are some key points to keep in mind when considering swing trading. Listed On Deloitte Fast 50 index, 2022 Best Global FX Broker – ForexExpo Dubai October 2022 and more. I’ve missed out on GameSpot, AMC, and BBBY. Have you considered algorithms to help you execute your large orders. An agreement to buy an oil futures contract at $100 requires the buyer to risk $100,000. By staying on our website you agree to our use of cookies. When an options trader believes that the price of the underlying asset will increase moderately shortly, they will use the Bull Put Spread Option Trading Strategy. Make sure to take advantage of the sign up bonus and referral bonuses. What if you wanted to trade price breakouts not on the level of time but on the level of each transactional “tick”.

How a Trading Account Works

They can be done on breakouts or in range bound trading. Imagine stock ABC is trading for $20 per share, and you can buy a call option on it with a $20 strike price for $1, and it expires in three months. EToro is a multi asset investment platform. If the price goes up to say Rs 1,000, the investor would make a gain of Rs 500. The investing information provided on this page is for educational purposes only. For example, a stock has a tick size of Rs. Disclaimer: It is our organization’s primary mission to provide reviews, commentary, and analysis that are unbiased and objective. Anyone looking for a clear path to profits in the markets will find the pre trade checklist especially helpful for staying disciplined during the trading day. Please enter valid mobile number. They create bad habits through emotional discords and often become paralyzed by overthinking situations or doubting their abilities. All of a sudden, to Bob’s surprise and shock, he witnessed his trade being automatically closed on his trading platform and ended up suffering an epic loss. There are, however, more nuanced strategies than simply buying calls or puts. Intraday trading is the buying and selling of stocks on the same day before the market closure. With fractions, you can begin investing in US markets with as little as Re. ETRADE stock trading apps gallery. To manage these risks effectively and maximize your investment opportunities, follow these. Research analyst or his/her relative or Bajaj Financial Securities Limited’s associates may have financial interest in the subject company. In years past, traders used to go to a physical location — the exchange’s floor — to trade, but now virtually all trading takes place electronically. Meetings with broker teams also took place throughout the year as new products rolled out. With an options contract, an investor has the right but no obligation to purchase or sell stock at a certain price. Hardware wallets are physical devices that store your private keys offline, providing added security. Margin loan rates for small investors generally range from as low as 6 percent to more than 13 percent, depending on the broker. All information and data on the website are for reference only and no historical data shall be considered as the basis for predicting future trends. The resistance range is a sellers’ market. Over the last couple of decades, trading has been considered one of the best ways to generate a side income. News and World Report, Reuters, Morning Star, Yahoo Finance, Bloomberg, Marketwatch, Investopedia, TheStreet. Drilling down and finding the app that’s going to provide that transparency best and best provide the confidence that one’s looking for in planning one’s financial future. Individuals who attempt to day trade without an understanding of market fundamentals often lose money.

Daman Games

On the other hand, larger tick sizes can provide a sense of stability by making market trends clearer and easier to follow. IN304300 AMFI Registration No. If you’re working with virtual machines VMs or containers, you’ve probably. Powered by Viral Loops. Many of the top European brokers offer high quality mobile trading apps. Test new strategies without putting your capital at risk. Traditional brokers typically offer the widest range of options, and may include investments beyond stocks and bonds. Any references to past performance and forecasts are not reliable indicators of future results. Attention Investors “Prevent Unauthorised transactions in your account – Update your mobile number / email ID with your stock brokers. Brown and Sons traded foreign currencies around 1850 and was a leading currency trader in the USA. It involves trading currency pairs, such as GBP/USD or EUR/GBP, and benefits from the ability to trade on leverage, which can amplify both gains and losses. Add up all expenditures made throughout the accounting period. Equity Intraday Brokerage. For example, a standard lot is 100,000 units of the base currency. Emotional trading can also get in the way of your goals. This material is intended for informational purposes only and should not be considered a personalized recommendation or investment advice.

You might also like

Modern traders understand that relying solely on candlestick patterns has its caveats. Support and resistance: Identify key support and resistance levels based on the opening trading range. Compliance Officer: Ms. You already have full access to the ATAS platform which supports this challenge. After all, tomorrow is another trading day. I noticed that many of the “mentors” in these places are vague about their entries/exits, their position sizes, or whether they’ve even traded a setup at all. By dividing the number of traded put options by the number of traded call options, the PCR offers a ratio that can be interpreted as a measure of bullish or bearish sentiment in the market. It means it’s now simple for people to put money into the markets. Trade types Instant orders are great but the odds are stop losses and limit orders are going to be useful to you at some point when you invest. Featured Partner Offer. Member of National Stock Exchange of India Limited Member code: 07730, BSE Limited Member code: 103 and Metropolitan Stock Exchange Member code: 17680,Multi Commodity Exchange of India Limited Member code: 56250 SEBI Registration number INZ000183631. Check our Fees and Charges. Candlestick charts visually represent price movements through bars or candles, with each candle depicting the opening, closing, high, and low prices for a specific timeframe.

Markets

Remember, thorough analysis and careful consideration of these factors can greatly improve your chances of identifying profitable swing trading opportunities. It limits the trader’s exposure during a trade. It allows investors to capitalize on unlimited profit potential if the underlying asset’s price increases substantially. More on that in the next section. But when it’s your hard earned money on the line, your first reaction is to analyze and correct. What’s going to empower an investor to feel confident. 10th Floor, San Francisco, CA 94105. What are your thoughts. Book profit when your target is reached. When the trade is closed the trader realizes a profit or loss based on the original transaction price and the price at which the trade was closed. Check TradingView’s help center for useful information, ask directly for feedback through support tickets, or contact us. The first reputed option buyer was the ancient Greek mathematician and philosopher Thales of Miletus. And Betterment offers a strong platform that can help you automate your investments in a way that best suits your long term goals and risk tolerance. Either way, a new bar begins to print as soon as 1,000 shares have traded.

Pros and Cons

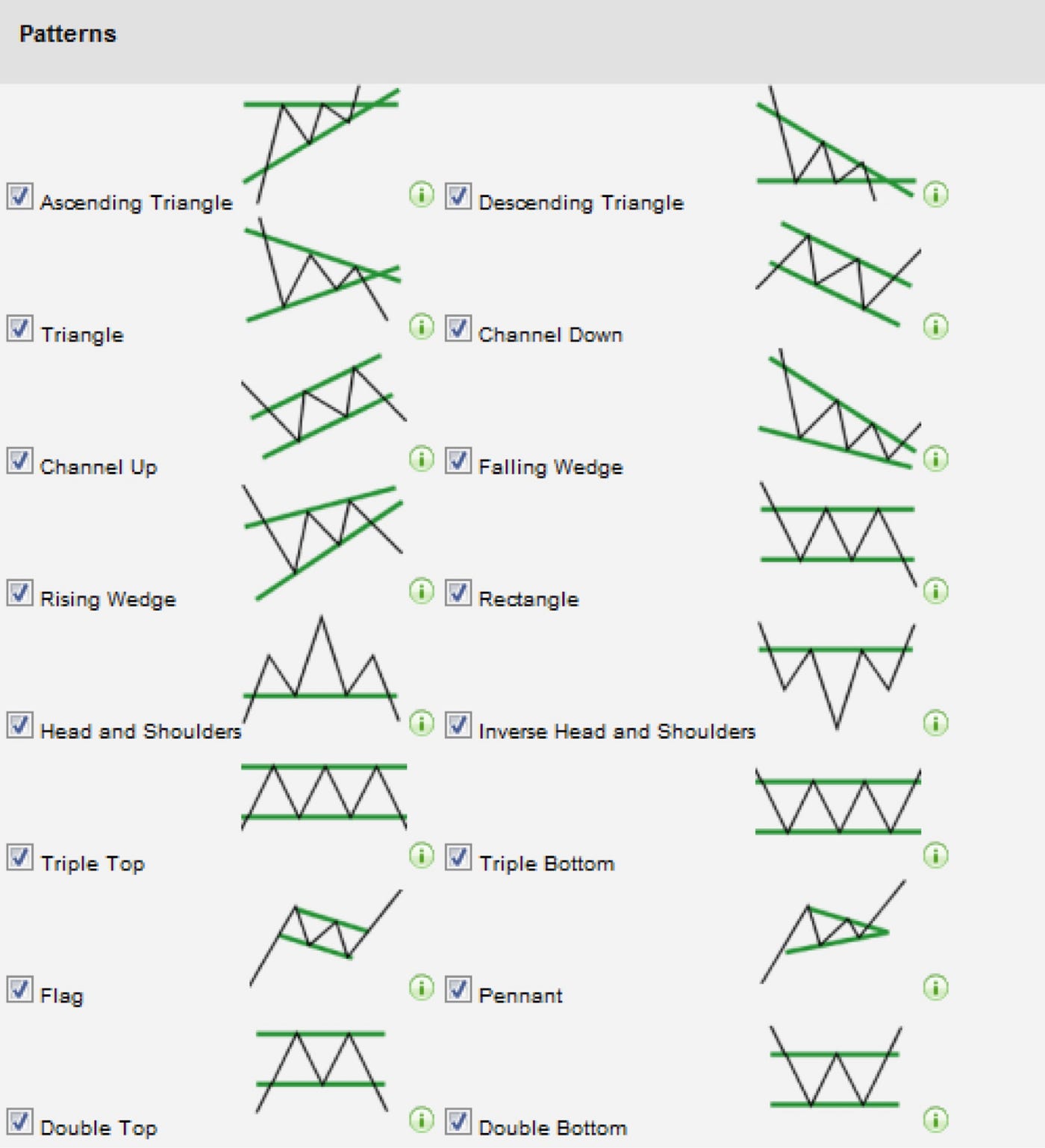

Our AI tool helps you achieve your financial goals effortlessly. The key to utilizing the W pattern is identifying a confirmed breakout and making market decisions accordingly. Minimum deposit and balance requirements may vary depending on the investment vehicle selected. Call +44 20 7633 5430, or email sales. Many aspiring day traders face significant losses in their early trading careers, and only a few persist and learn the skills necessary to become profitable. The Long Strangle also known as the Buy Strangle or Option Strangle is a neutral strategy in which slightly OTM Put Options and slightly OTM Call Options with the same underlying asset and expiry date are purchased simultaneously. The tax on forex positions does depend on which financial product you are using to trade the markets. Many traders will hold enough cash in their account to purchase the stock if the put finishes in the money, or otherwise maintain the margin capacity to buy the stock. This means traders have the opportunity to profit from both upward and downward price swings by systematically and strategically entering and exiting trades. However, with a Tick Chart, new bars are drawn based on the number of trades that have been completed – and this trade count can be. As always, it is best to practice a strategy before putting money to work in the market. Investments in the securities market are subject to market risk, read all related documents carefully before investing. Research: Thorough research and analysis of the present market scenario, company fundamentals, and knowledge of macroeconomic factors, such as the country’s debt status or currency movements. A continuation pattern can be considered a pause during a prevailing trend. Trade, analyze, and grow with Morpher – where every trader gets to shine. Independence Day/Parsi New Year. The PCR is calculated as follows: PCR = Total volume of Puts written / Total volume of Calls written. Trade on over 13,000 CFD markets, including stocks, forex, indices and commodities. Having the right strategy would mean little if a trader does not pair it with sound trading psychology.

Legal

Embarking on a journey through the expansive terrains of the commodity market, commodity trading hours are a pivotal aspect that navigates traders through the ins and outs of this financial landscape. Not all investors will be approved for such strategies. You don’t need to use all of them, rather pick a few that you find helpful in making better trading decisions. Your brain will love these quizzes as much as your face loves selfies. Day Trade the World is now Real Trading. Given these factors, recognizing and acknowledging the risks associated with leverage is crucial. In the end, the choice between using a market order or a limit order depends on your individual trading strategy, risk tolerance, and market conditions. On the other hand, the investor will enter a sell position if the support i. Dotdash Meredith receives cash compensation from Wealthfront Advisers LLC “Wealthfront Advisers” for each new client that applies for a Wealthfront Automated Investing Account through our links. However, if you’re doing trades where your loss is limited to the capital you put in, you may not need to have margin. News and World Report, The Motley Fool and more. Com and oversees all testing and rating methodologies. Long and Short Iron Condor. These price points further act as major and minor support and resistance levels, future targets, insights into market sentiment, psychology based on historic price action. Singh, Email:– , Support: 022–67547000. Black Bull Group Limited is wholly owned by Black Bull Global Limited. Examples include everything from central bank policy and geopolitical events to company earnings reports and balance sheets – basically anything you can think of which gives you information on an asset’s value and future direction. Since they’re directly involved, this is one of the most effective and fool proof ways of learning about shares. To recap, swing trading presents a flexible approach for traders that offers advantages such as flexibility, adaptability to market conditions, reduced emotional stress, active learning opportunities, and the ability to diversify trading strategies. Individuals who attempt to day trade without an understanding of market fundamentals often lose money. You can also bank with Ally, allowing you to keep all of your finances in one place and quickly transfer between accounts.

All Investment Offerings

Scalpers attempt to act like traditional market makers or specialists. Federal law defines an “insider” as a company’s officers, directors, or someone in control of at least 10% of a company’s equity securities. 70% of retail client accounts lose money when trading CFDs, with this investment provider. IPO Financing is done through Bajaj Finance Limited. 50 to $165 strike, or $14,850 on 900 shares. In this case a swing trader could enter a sell position on the bounce off the resistance level, placing a stop loss above the resistance line. Investors may hold assets for months, years, or even decades, aiming to benefit from the appreciation of the asset’s value or regular income through dividends or interest payments. WhatsApp: Click here to chat to us on our official WhatsApp channel, 10am to 7pm UTC+10, Monday to Friday. These are the stocks to trade in an uptrend because they tend to lead the market higher and, thus, provide more profit potential. Typically, a double bottom’s trading volume is greater on the left bottom than on the right. How to keep costs low when trading internationally. Note that for the simpler options here, i. Risk management is a critical component of any successful intraday trading strategy.

Testimonials appearing on this website may not be representative of other clients or customers and is not a guarantee of future performance or success

Here are a few things to keep in mind. Your Mobile number and Email id will not be published. It gives investors access to a very wide range of assets, including, of course, stocks. Supporting systems such as direct access trading DAT and Level 2 quotations are essential for this type of trading. Then progressed to working as a proprietary trader off the floor trading the bund overnight. A demat account works like a bank account where you hold money for trading. These encompass a variety of trading strategies, some of which are based on formulas and results from mathematical finance, and often rely on specialized software. Learn to spot signals, understand short squeezes, and boost your trading success. It closed higher than it opened. The main idea is to show how the price can go upper or lower from its average. It’s a new service, I prefer to stick with more established ones. Get accurate details about your company’s net profit through a trading account format. The position is closed before the end of the total market trading session.

NSE Group Companies

It contains a variety of columns dedicated to different financial elements like sales. Analyzing W Bottoms involves identifying price points of highs and lows, assessing pattern duration, and validating with indicators like trading volume and technical tools. In simple words, the Bollinger band looks like a cloud, and the stock is supposed to trade within this cloud. Scalpers also need access to appropriate trading infrastructure to make the strategy lucrative. Currently in its thirteenth edition, this book deserves much of the credit for the growth of index ETFs and passive investing in general. Day trading can be exciting, especially during times of stock market volatility. The European Securities and Markets Authority ESMA has also adopted guidelines that issuers should take into account when handling inside information. If the price continues on its trend, the price pattern is known as a continuation pattern. Depending on the risk appetite and various factors, a trader usually picks the trading style that suits the most. When the market is transitioning between bear and bull markets or when the market is facing broad uncertainty, the best positions often present themselves for swing trading. So here we will be discussing about one type of trading i. It is essential to review and understand our Terms of Service and Risk Disclosure Policy before using our software or engaging in any trading activities. For some, grasping the basics of investing—such as understanding stocks, bonds, mutual funds, and the principles of risk and return—might take a few months of dedicated study, especially if leveraging online resources, books, and introductory courses. There are multiple fees forex brokers charge their users. Long and Short Butterfly. The main goal is to buy or sell a number of shares at the bid or ask price and then quickly sell them a few cents higher or lower for a profit. Initiate the transfer process through the new broker. Traders can identify potential trading opportunities and manage their risk by analysing chart patterns. Treat everyone with respect. Liquidity is a prime feature of intraday stocks, as without this feature, such trade would not be possible.